If you’re thinking about getting into online trading Demat Account, congratulations! You’re about to embark on an exciting journey that can lead to financial success. But before you start trading, there are a few things you need to know.

In this blog post, we’ll cover the basics of online trading and provide some tips on how to get started. We’ll discuss things like what types of online trading app are available, how to choose the right one for your needs, and how to open and fund your account. We’ll also touch on some important things to keep in mind as you begin trading, like researching the market and managing your trades.

By the end of this post, you should have a good understanding of the basics of online trading and be ready to start making trades of your own. So let’s get started!

Get Educated on the Basics of Online Trading.

When you first start trading online, it’s important to get familiar with the different types of trading platforms and apps available. Some popular options include:

-Web-based trading platforms: These platforms are accessed via your internet browser. They tend to be user-friendly and offer a variety of features but can be slower than other types of platforms.

-Downloadable software platforms: These platforms must be downloaded and installed onto your computer before you can use them. They typically offer more advanced features and faster speeds but can be more difficult to use.

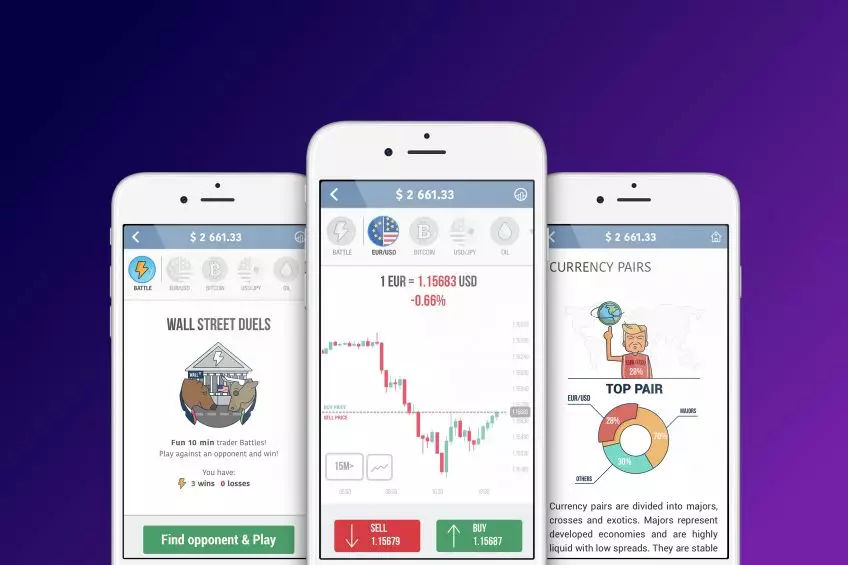

-Mobile trading apps: These are designed for use on smartphones and tablet devices. They offer convenience and flexibility but may have fewer features than other types of platforms.

Understand the Different Trading Risks.

Before you start trading, it’s also important to understand the risks involved. Some common risks to consider include:

-Market risk: This is the risk that the value of your investments will go down due to changes in the wider market.

You can mitigate market risk by diversifying your portfolio across a range of different asset classes (e.g., stocks, bonds, cash).

-Counterparty risk: This is the risk that the person or institution you’re trading with will not fulfill their obligations (e.g., if they default on a trade).

To protect yourself from counterparty risk, make sure you only trade with reputable firms that have a good track record.

-Liquidity risk: This is the risk that you’ll be unable to sell an asset when you want to because there are no buyers available in the market.

You can mitigate liquidity risk by only investing in liquid assets (e.g., stocks listed on major exchanges).

Comments are closed.